Climate-Related Risks and Opportunities

Our sustainable strategy compels us to incorporate management of our climate-related risks and opportunities into our decision making. Changes in market preferences, public policies, legislation and regulations, technologies and climate and weather-driven events provide both risks and opportunities, which we carefully review, evaluate and manage to strengthen our resiliency.

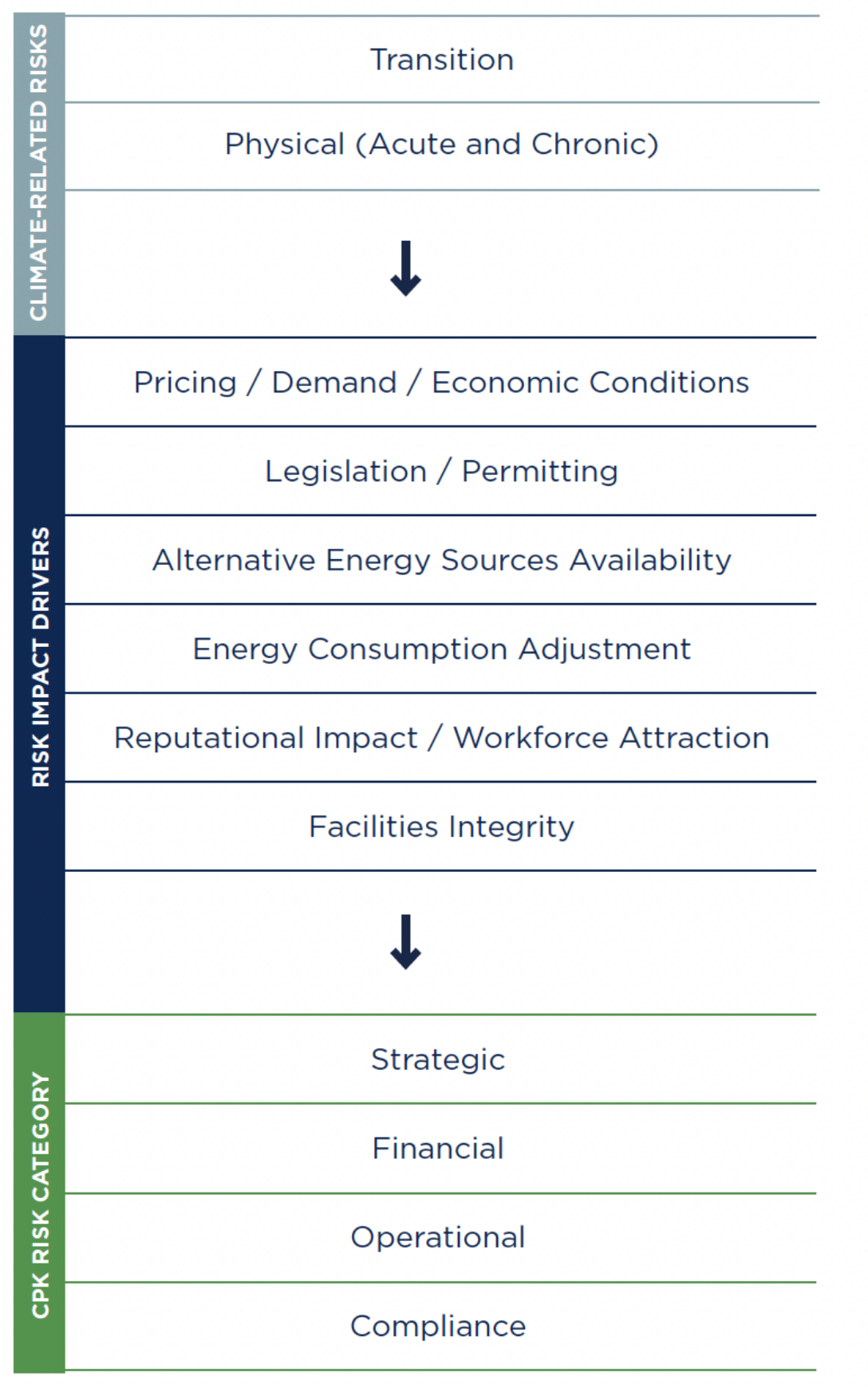

The identification of climate-related risks and opportunities are a part of our overall business risk identification and strategic planning process, and the impact of such risks and opportunities are reflected in our Enterprise Risk Management (ERM) risk universe, financial performance and our strategic planning. Our ERM process utilizes both bottom-up and top-down assessments to understand our risks as they are perceived on all fronts of the organization. Our Risk Management Committee (RMC), comprised of senior level executive officers, receives regular updates regarding risks and emerging risk trends identified through our ERM process. The RMC then provides feedback on risk management and mitigation strategies, which filter back within the top-down and bottom-up ERM assessments. Changes in our risk profile resulting from the quarterly ERM update are discussed with the Audit Committee and the full Board of Directors. Our structure helps to ensure continual communication of risk-related items and fosters our strong risk management culture.

Our SEC filings outline our most material business risks, including financial, operational, regulatory, legal and environmental, and include discussion on the climate-related transition and physical risks faced by our Company. Our climate-related opportunities include opportunities to provide new lower-carbon services and increase resiliency (such as through locally sourced renewable natural gas, and hydrogen blending), and opportunities for efficiency increases and emissions reductions.

Our holistic approach to enterprise risk management aids in risk identification and mitigation, informing Company strategy, managing performance and capitalizing on opportunities.

Alignment with TCFD and SASB

We report our climate-related sustainability disclosures, including climate risks and opportunities, through two internationally-recognized reporting frameworks, TCFD (Task Force on Climate-Related Financial Disclosures) and SASB (Sustainability Accounting Standards Board).

Our TCFD table provides our stakeholders with additional information related to our governance, risk management, strategy and the metrics we are using to assess our performance related to our climate-related risks and opportunities.

We report SASB’s industry-specific metrics for our natural gas distribution operations and our midstream transmission operations. The SASB metrics were developed to identify the subset of ESG issues most relevant to the financial performance of the applicable industry, which includes climate-related ESG issues.

View Our SASB Table for Our Natural Gas Distribution Operations »

View Our SASB Table for Our Midstream Transmission Operations »